regular holiday pay|legal holiday pay rules dole : iloilo The labor department issued Labor Advisory No. 12, series of 2019, to guide private sector employers on the payment of wages for the special non-working days and regular . HOMO.XXX is free gay porn tube. Explore true beauty and passion of gay sex. You can watch at our tube horny and nude male pornstars in xxx gay movies.

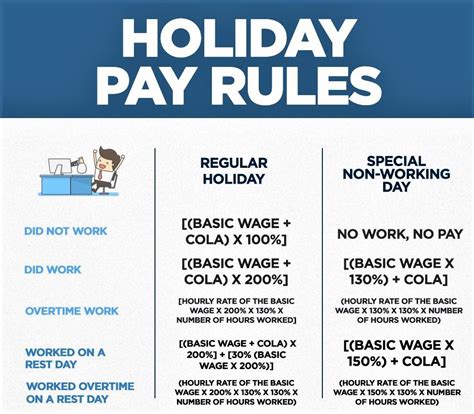

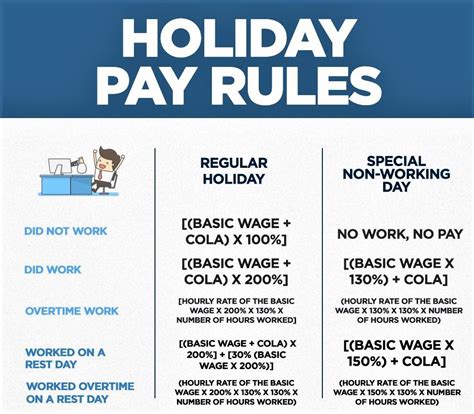

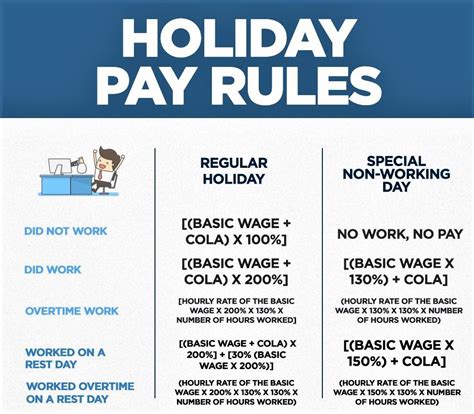

regular holiday pay,Holiday pay is an additional pay provided to a covered employee during regular holidays, whether or not the employee worked. It depends on whether the employee performed work or not, and it is mandated by the law. The web page explains .Labor Standards. Computation of Holiday Pay. During regular holidays, 100% pay . Learn how to calculate holiday pay for regular and special non-working holidays in the Philippines, as mandated by the Labor Code. Find out who is entitled to .regular holiday pay legal holiday pay rules doleLearn how to calculate the employee's holiday and rest day pay based on the hourly rate, working hours and the type of holiday. Find out the different types of holiday pay rates and examples of computations for regular, .The labor department issued Labor Advisory No. 12, series of 2019, to guide private sector employers on the payment of wages for the special non-working days and regular .Learn how employers should pay employees for official and special holidays in the Philippines, including regular holidays, special non-working days and special working holidays. Find out the percentage of .Department of Labor and Employment

Learn how to compute regular and special non-working holiday pay for employees in the Philippines, following the DOLE regulations. Find out the impact of .Oct 31, 2023 4:32 PM PHT. Rappler.com. (2nd UPDATE) The Labor Code says workers are entitled to their full daily pay during regular holidays, even if they do not go to work. .

Learn how to compute holiday pay for regular and special holidays in the Philippines according to labor laws. Find out the differences, pay differentials, and .regular holiday payIf the employee works during the regular holiday, the employee shall be paid 200 percent of his/her regular salary for that day for the first eight hours. If the employee works more than eight hours (overtime work), .

DOLE issues guideline on Holy Week holiday pay. Employees who will work from Maundy Thursday, March 28 to Black Saturday, March 30, are entitled to special wage as all the dates were declared as either a regular holiday or a special non-working holiday, the Department of Labor and Employment (DOLE) said. In its Labor Advisory .

Wages for Regular Holiday. If you're working on a regular holiday, which includes April 6, 7, and 10, these are the wage rules based on a labor advisory: If you render work on these days, you will be paid double or 200% of your wage for the first eight hours. If you work overtime— or in excess of eight hours—you will be paid an additional .Department of Labor and Employment

For part-time workers, holiday pay entitlements are prorated based on the number of hours worked relative to full-time employees. The holiday pay calculation takes into account the number of hours worked on the holiday and the employee's regular rate of pay. Part-time workers are entitled to receive holiday pay equivalent to the amount .Holiday pay laws should be closely followed by all companies open for business on state or federal holidays. 3 min read updated on February 01, . However, under federal law, employers must pay employees time and a half for those hours worked in excess of the normal 40-hour workweek schedule. Moreover, in some states, including California, .

Learn the difference between regular holidays and special non-working days in the Philippines, and how they affect workers' pay and benefits.

Apr 6, 2024 00:32 AM. Private sector employees who will render work on the observance of the Day of Valor on Tuesday, April 9 and Eidl' Fitr on April 10 are entitled to an additional wage as all the dates were declared a regular holiday, the Department of Labor and Employment (DOLE) said. In a released statement on Friday, April 5, DOLE's . The holiday pay that each employee receives depends on the terms of their employment contract (the holiday pay rate is the same as an employee’s standard rate of income). Moreover, full-time Amazon employees receive 1.5 x their regular hourly rate if they choose to work on one of these federal holidays.A. Employee wage payment for regular holidays. There are ten (10) actively enforced regular holidays for 2024 in accordance with the guidelines set by Proclamation No. 368, signed by Executive Secretary Lucas Bersamin. It states that the regular holidays for 2024 are as follows: DATE. Holiday. January 1, 2024:To determine the employee Legal/Regular Holiday pay: Legal/Regularly Holiday Pay = (Hourly rate × 200% × 8 hours) Php 912.00 = (Php 57.00 × 2.00 × 8 hours) Working on Legal/Regular Holiday and at the same .

📌 The calculation formula for a regular public holiday: (Basic Pay + COLA) x 200%. If your daily rate is Php 900.00, multiply this figure by 200%. The result is Php 1,800.00. If you work more than eight hours on a regular public holiday, you will be paid an additional 30% of your per-hour wage for each additional hour worked.

To break it down: Normal pay per day worked x 1.5 (for time-and-a-half), or x 2 (for double-time) = Holiday Pay. Normal workday, normal pay: As an employer, you can determine if a holiday is or .

For regular holidays, the multiplier is 200% for the first eight hours of work, while for special holidays, the multiplier is 130%. 5. Consider Overtime Pay: If employees work beyond the regular eight hours on a regular holiday, compute the overtime pay differential by applying an additional 30% of the hourly rate for each hour of overtime work.

Dec 31, 2020 01:11 AM. The Department of Labor and Employment (DOLE) has issued pay rules for employees in the private sector who will report to work on New Year's Day, January 1, 2021. The prescribed pay rules for January 1, a regular holiday, was explained in Labor Advisory No. 34, series of 2020, signed by DOLE Secretary Silvestre Bello III.

Regular Holiday Pay = [(basic daily wage x 200%) x 30%] + [(basic daily wage + COLA) x 200%] Suppose the employee works for more than eight hours on a regular holiday that falls on that employee’s rest day. In this case, the employee should receive a holiday pay amounting to 30% on top of the overtime pay given on regular . Payment of Wages on a Regular Holiday. An employee who does not work on a regular holiday is entitled to be paid 100% of their salary for that day. [basic wage x 100%] An employee who works on a regular holiday is entitled to 200% of their salary for that day. [basic wage x 200%]

Fact Sheet #56A: Overview of the Regular Rate of Pay Under the Fair Labor Standards Act (FLSA) . In the case where an employee reports to work on the holiday and is paid for hours worked plus the holiday payment, the holiday payment is excludable from the regular rate, because it is not considered a payment for hours worked. .

regular holiday pay|legal holiday pay rules dole

PH0 · philippine regular holiday pay

PH1 · legal holiday pay rules dole

PH2 · how is holiday pay calculated

PH3 · holiday pay rules dole example

PH4 · holiday pay regular overtime

PH5 · holiday pay for hourly employees

PH6 · dole guidelines on holiday pay

PH7 · calculating holiday pay and overtime

PH8 · Iba pa